Mashroo3k Consulting Company offers a feasibility study for a martial arts club project, with the highest return on investment and the best payback period. This study is based on a series of in-depth studies of the size of the Yemeni market, an analysis of the strategies of local and foreign competitors, and the provision of competitive pricing.

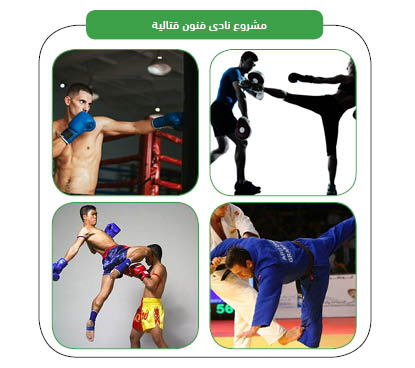

Martial arts comprise a set of combat and defensive techniques, both unarmed and sometimes with weapons. Martial arts help achieve self-control and emotional discipline. Martial arts aim to develop an individual’s spiritual and moral side. The Martial Arts Club offers training and educational programs in various martial arts, such as karate, taekwondo, judo, aikido, Brazilian jujitsu, and various types of boxing. The project targets adults and children in schools and universities. The club operates under a set of cooperation protocols with various institutes, schools, and universities. Mashroo3k Consulting Company provides investors interested in investing in a martial arts club project in Yemen with a set of specialized feasibility studies based on updated databases specific to the Yemeni market. This helps ensure the project’s success, achieves the highest return on investment, and provides the best payback period.

Executive Summary

Study of the project’s services/products.

Market Size Study

Risk assessment study.

Technical study.

Financial study.

Organizational and administrative study.

Believing in the role of the entertainment sector in building non-oil-dependent economies, Mashroo3k Consulting presents the following key indicators of the sector in the Gulf Cooperation Council (GCC) countries:

According to the latest statistics, the number of museums in the GCC countries stands at 306, with a total of 6,032,840 visitors.

The number of hotel establishments in the GCC countries is 11,119.

The number of entertainment events reached 690, with a total of 9,784 event days. These events attracted 34,699,458 attendees.

There are 33 museums dedicated to archaeology, history, and heritage.

The number of private museums is 195.

There are 8,499 archaeological sites, with 178,020 visit permits issued annually.

The entertainment sector is expected to contribute 4.2% to Saudi Arabia’s GDP in the coming years.

According to the latest statistics, the number of museums has reached 41, with 2,322,807 visitors.

There are 260 public parks.

The number of museums has reached 12, with more than 408,000 visitors recorded.

Oman has 51 forts and castles, which attracted 427,000 visitors.

Qatar has 291 sports facilities, with football stadiums being the most common (90 stadiums), followed by indoor sports halls (37 halls).

There are 99 cinemas with a total seating capacity of 14,108. The number of films screened, according to the latest statistics, is 3,549.

The annual number of visitors to museums and exhibitions in Qatar is 1,038,470.

The number of visitors to the Kuwait Touristic Enterprises Company, which provides various entertainment and recreational services, has reached 1,308,514.

Museum visitors in Kuwait total 108,987.

Kuwait has 814 libraries, with a classified collection of over 2,087,513 books.

The governments of the GCC countries are striving to improve the quality of life and provide a high level of well-being for their citizens by investing in the entertainment sector. In recent years, these governments have launched initiatives aimed at increasing the number of parks, live entertainment shows, and encouraging visual and performing arts.

The entertainment and hospitality construction market in the GCC is expected to reach $642.3 billion by 2023, up from $466.9 billion in 2019.

According to the United Nations World Tourism Organization, the GCC countries are expected to receive 195 million visitors by 2030.

In 2021, the global entertainment and media market was valued at $2.34 trillion. It is expected to grow at a compound annual growth rate (CAGR) of 4.6%, reaching $2.93 trillion by 2026.

Mashroo3k Consulting recommends investing in the entertainment sector due to its rapid growth and promising investment opportunities, based on the following indicators:

Global Video Game Industry:

In 2021, total global video game revenues reached $214.2 billion, and they are expected to grow to $321.1 billion in the coming years.

Global Cinema Revenue:

Global cinema revenues are expected to grow at an average annual rate of 20.4% between 2021 and 2026.

Metaverse Investment Opportunities:

According to Citibank projections, investment opportunities in the metaverse could reach $13 trillion by 2030.

Virtual Reality (VR) Spending:

Global spending on VR increased by 36.5% in 2021, reaching $2.6 billion, and is expected to grow at a compound annual growth rate (CAGR) of 24.1% between 2021 and 2026, reaching $7.6 billion.

Console Game Revenue Growth:

The average annual growth rate for console game revenues is 2.2% during the 2021-2026 period.

PC Game Revenue Growth:

The average annual growth rate for PC game revenues is 4.6% during the 2021-2026 period.