The business incubator is an integrated platform that aims to support entrepreneurs and startup owners during the early stages of establishing their projects. The incubator offers a range of comprehensive services, including logistical support, such as providing co-working spaces equipped with the latest technologies, as well as financial facilities such as soft loans and financing support to ease the financial burden on new projects. The incubator also works to develop innovative marketing strategies that help startups reach their target audience and increase their chances of success in the market. Additionally, the incubator provides guidance and human resources management services, helping build strong and effective teams capable of achieving desired goals. The business incubator also plays a significant role in resolving administrative issues and organizing internal operations for projects, contributing to increased operational efficiency and productivity. Through their ongoing support, business incubators contribute to enhancing the contribution of small and medium-sized enterprises (SMEs) to the GDP, creating new job opportunities, and reducing unemployment rates, making them one of the most important tools for sustainable economic development.

The business incubator is a vital project that aims to provide comprehensive support to entrepreneurs and startups, contributing to the sustainability and growth of small and medium-sized enterprises (SMEs). The incubator is distinguished by its ability to build strong relationships with government agencies, which contributes to facilitating procedures and providing a conducive environment for project success. The incubator also offers various services, including logistical support, professional guidance, and practical training, in addition to financing facilities that enable startups to gain a solid foothold in the market. The business incubator enjoys a prime location, making it accessible to all, as well as its ability to build strategic partnerships with investors and financial institutions, providing additional support to entrepreneurs. It also boasts diverse revenue sources, ensuring its continuity and flexibility in the face of economic challenges. Furthermore, the incubator contributes to opening new markets for startups, enhancing their opportunities for expansion and growth. Thanks to this diversity and excellence, the business incubator is a strategic choice for anyone seeking comprehensive and integrated support and a profitable investment opportunity with sustainable growth potential.

Strong relationships with government agencies.

Diverse services provided (logistics, career guidance, training, financing facilities).

Building strong partnerships with investors and financial institutions.

A prime location.

Diversified revenue sources.

The ability to open new markets.

Executive summary

Study project services/products

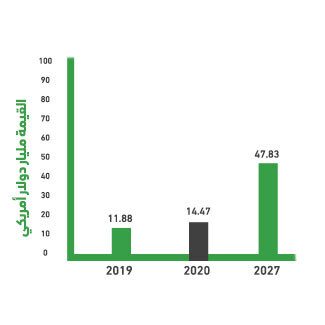

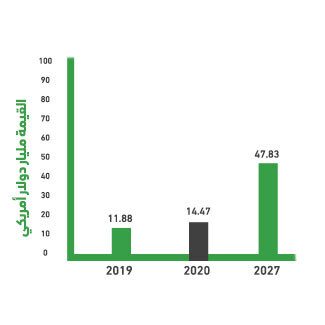

Market Size Analysis

Risk Assessment

Technical study

Financial study

Organizational and administrative study

The service sector represents an important part of the economy, in fact, it represents the largest part of the global economy. The service sector is considered an industry and a science, focusing on the production of services rather than tangible goods, such as cars, aircraft, machinery, and equipment. The service sector is concerned with providing services to people, including banking, communications, wholesale and retail trade, engineering, medical services, tourism, and non-profit economic activities such as customer service and government services that include development, national defense, and maintaining internal and external security.

The commercial sector includes the e-commerce sector and the wholesale and retail trade sector. The commercial sector in the Kingdom has witnessed numerous developments during the years of the Ninth Development Plan. The number of commercial registrations issued by the end of the fourth year (2013) of the Ninth Development Plan increased to exceed 1.37 million registrations, while the number of companies reached more than 86,000. The number of licenses for installment sales, debt collection, and follow-up services reached 115,000. The recently released annual report issued by the Ministry of Commerce for the year 1435 AH revealed that the commercial sector contributed to the gross domestic product.

The relative contribution of commercial activities to GDP increased, with the wholesale and retail trade, restaurants, and hotels sectors contributing 8.8% to GDP, and construction and building 4.4%.

The number of internet users in the Kingdom increased from 19.6 million to 24 million between 2014 and 2016, according to a 2016 report by the Communications and Information Technology Commission. E-commerce is experiencing significant growth due to the availability of convenient payment methods, improved shipping methods, and changes in societal culture in recent years, driven by the availability of social media and the proliferation of smartphones, which have become an effective channel for completing many purchases.

Data from the Saudi Payments Network (SPA) revealed that 2015 saw the recording of more than 1.1 billion financial transactions, with a total value exceeding 626.3 billion riyals, with an average monthly transaction volume exceeding 52 billion riyals. This was done through more than 17,000 ATMs and over 225,000 POS terminals spread across the Kingdom.

The data added that last year saw steady growth in the number of POS terminals at payment outlets, increasing by 62% compared to the previous year.

The number of internet users worldwide reached 3.2 billion, with 157 million internet users in the Arab world. There are 11 million Facebook users in Saudi Arabia, including 3.2 million expatriates. There are 9 million Twitter users in Saudi Arabia, and 8.8 million Instagram users. Sixty percent of internet users in Saudi Arabia shop online, and 40% of online purchases are focused on mobile phones and accessories. 71% of shoppers in the Kingdom are young people, and 29% are women.