A Look at E-commerce Statistics in the GCC Countries:

In 2015, e-commerce contributed approximately 0.4% of the total GDP of the GCC countries, amounting to $5.3 billion.

By 2020, with the economic shifts brought by the COVID-19 pandemic, the e-commerce market in the GCC became one of the fastest-growing markets worldwide, with a growth rate exceeding 35%. The market size was estimated at around $24 billion, surpassing earlier forecasts of $21.6 billion.

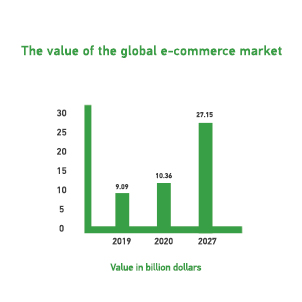

Here’s a detailed look at the size of the e-commerce market in the GCC over the past five years:

-

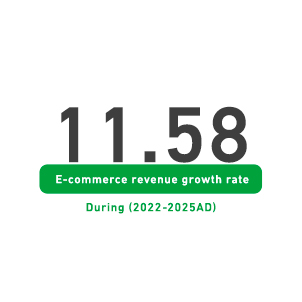

Global reports predict that e-commerce in the GCC will grow at a faster pace between 2020 and 2022 at a rate of 20%, followed by 14% growth until 2025. Without COVID-19 and its economic impact, these rates would have been 14% and 10%, respectively.

-

The average percentage of households purchasing goods online increased from 2% to over 8%. In developed countries such as the United States, South Korea, and Germany, this percentage ranges between 16% and 25%. However, indicators suggest that the GCC countries will soon reach global levels.

-

Online visits to major shopping websites grew by 50% in 2020 compared to 2015, with the number of users rising from just 3 million to 21 million.

-

The number of e-commerce platforms and applications has tripled compared to 2015.

-

The time users spend on shopping websites such as Amazon, Namshi, and Noon has increased significantly, with daily average browsing times reaching 9 to 12 minutes and users viewing 7 to 8 pages per visit.

-

Food delivery and grocery services are among the fastest-growing e-commerce sectors, with a 20% growth rate and a market size of $3 billion in the GCC.

-

Fashion and beauty sectors present a significant investment opportunity, with an 18% growth rate and a market size exceeding $5 billion in the GCC.

A Detailed Outlook on GCC E-commerce Growth Forecasts (Next Five Years):

-

60% of millennials shop online.

-

By 2025, the GCC e-commerce market is expected to reach $50 billion.

-

Millennials make up more than 45% of the GCC population, making e-commerce a highly promising market in the region.